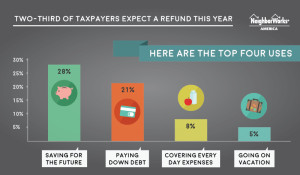

According to NeighborWorks America, a national, nonpartisan nonprofit, more than one-fifth (21%) of Americans plan to use their expected tax refund to pay down or pay off debt, while under ten percent will use the money to pay everyday expenses. According to NeighborWorks, “The millions of adults who will use their tax refund in this way underscores the fragility of finances for millions of Americans, particularly for those who have the lowest incomes.”

For a clear, easy to read chart showing the various uses to which refunds are put, click here. I guarantee you that you will be surprised by what you see.

Your Money Wiz